Employee Stock Ownership Plans create unique compensation dynamics that fundamentally differentiate employee-owned companies from their conventionally structured competitors. While traditional organizations focus primarily on cash-based rewards and market positioning, ESOP companies must navigate the complex interplay between immediate compensation needs, long-term ownership value, and the financial obligations inherent in employee ownership structures.

For C-suite executives and human resources leadership, this complexity presents both strategic opportunities and operational challenges that require sophisticated approaches to total rewards design. The most successful ESOP organizations recognize that compensation alignment extends far beyond competitive benchmarking to encompass ownership education, cash flow management, and the delicate balance between individual recognition and collective value creation.

The Strategic Imperative: Beyond Traditional Compensation Models

ESOP organizations face compensation challenges that conventional companies never encounter. Unlike traditional equity programs that serve primarily as retention mechanisms for senior executives, ESOPs create enterprise-wide ownership obligations that directly impact cash flow, competitive positioning, and talent management strategies.

The fundamental challenge lies in optimizing the relationship between three interconnected variables: immediate compensation competitiveness, long-term ownership value appreciation, and sustainable cash flow management. Organizations that fail to address this complexity systematically often experience talent retention issues, employee disengagement, or financial constraints that limit their ability to compete effectively in their markets.

Critical Compensation Challenges in Employee-Owned Organizations

Temporal Value Perception and Cash Flow Pressure

ESOP companies regularly encounter situations where significant ownership value accumulation creates pressure for enhanced cash compensation. Employees may undervalue future ESOP distributions in favor of immediate wage increases, creating tension between ownership wealth-building and current market competitiveness.

This dynamic is particularly pronounced in high-performing ESOP companies where rapid share value appreciation contrasts with conservative cash compensation approaches. The result is often employee perception of being “equity rich but cash poor,” which can undermine engagement and ownership culture development.

Market Competitiveness Under Ownership Constraints

The reinvestment requirements and repurchase obligations inherent in ESOP structures can limit available cash for competitive compensation adjustments. Organizations must balance the imperative to maintain market competitiveness with the financial discipline necessary to sustain ownership obligations and business growth investments.

This challenge intensifies in competitive talent markets where conventional employers can offer immediate cash premiums or equity arrangements without the long-term financial obligations that ESOPs require.

Differentiated Value Proposition for Key Contributors

While ESOPs democratize ownership across the entire workforce, high-performing organizations still require mechanisms to recognize and retain exceptional contributors. The broad-based nature of ESOP ownership can create situations where key talent perceives limited differentiation in their total rewards package compared to average performers.

This presents challenges in competitive fields where targeted retention bonuses, individual equity awards, or performance-based cash incentives are standard practice among non-ESOP competitors.

Repurchase Liability Management and Compensation Planning

The obligation to repurchase departing employees’ ESOP shares creates long-term cash flow commitments that directly impact compensation budget planning. Organizations must develop sophisticated financial modeling capabilities to balance current compensation investments with future repurchase obligations.

This requirement for long-term financial planning often exceeds the capabilities of traditional HR and finance functions, necessitating specialized expertise in ESOP financial management and cash flow projection methodologies.

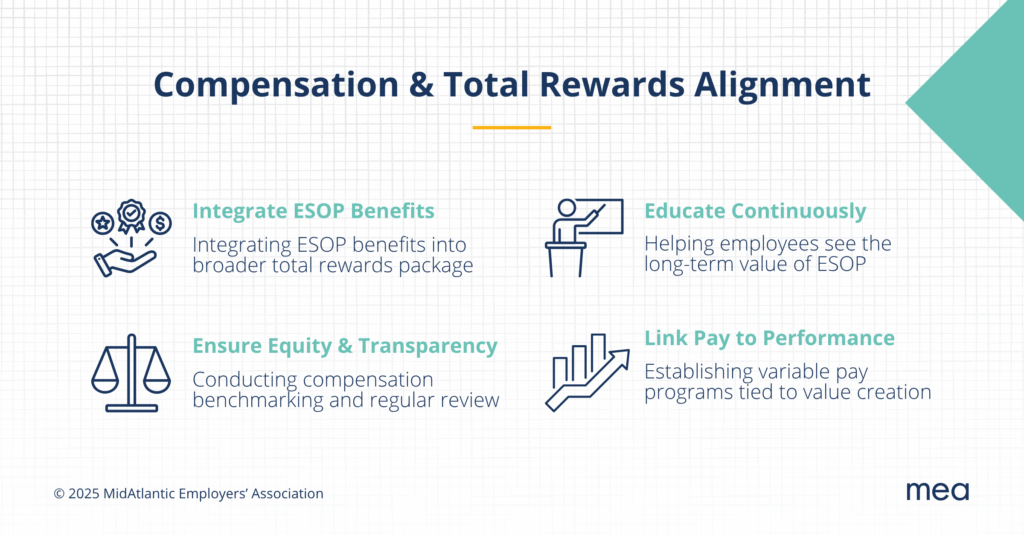

Strategic Framework for Total Rewards Optimization

Integrated Value Communication Strategy

Effective ESOP compensation management requires comprehensive communication strategies that position ownership value as a central component of total rewards rather than a supplementary benefit. This approach demands sophisticated educational programs that help employees understand the relationship between current business performance, long-term ownership value, and personal financial planning.

Leading organizations implement quarterly business updates that explicitly connect operational results to ESOP share value changes, supplemented by individual ownership statements that project long-term wealth accumulation scenarios based on various performance assumptions.

Performance-Based Differentiation Within Ownership Structure

Successful ESOP organizations develop supplemental reward mechanisms that recognize exceptional performance while maintaining the democratic ownership principles that define employee ownership. These approaches include performance-based cash bonuses, phantom stock arrangements, or profit-sharing programs that reward individual contribution without compromising broad-based ownership principles.

The most effective programs link individual performance rewards to enterprise value creation, reinforcing the connection between personal achievement and collective ownership success.

Dynamic Market Positioning and Financial Planning

Compensation competitiveness in ESOP organizations requires ongoing analysis that considers both immediate market positioning and long-term total rewards value. This analysis must account for projected ESOP value appreciation, repurchase liability timing, and competitive dynamics in relevant talent markets.

Organizations with mature compensation strategies conduct annual total rewards modeling that projects five-year compensation scenarios under various business performance assumptions, enabling proactive adjustments to maintain competitive positioning while honoring ownership obligations.

Implementation Considerations and Organizational Capabilities

Internal Capability Requirements

ESOP organizations must develop internal capabilities in ownership education, financial literacy training, and total rewards communication that exceed requirements in conventional companies. HR teams require specialized knowledge of ESOP mechanics, valuation methodologies, and the regulatory environment governing employee ownership.

These capabilities include designing role-specific ownership education programs, developing total compensation communication tools, and managing the integration between performance management systems and ownership culture development.

External Expertise Integration

The complexity of ESOP compensation optimization often exceeds internal organizational capabilities, particularly in areas such as competitive benchmarking adjusted for ownership value, incentive program design that complements ESOP structures, and long-term financial modeling for repurchase liability management.

External expertise becomes particularly valuable for organizations implementing major compensation strategy changes, developing new performance-based incentive programs, or navigating significant transitions in business performance or ownership value.

Specialized consulting support provides objectivity in compensation benchmarking, technical expertise in incentive design, and analytical capabilities for financial modeling that most internal teams cannot replicate cost-effectively.

Measuring Success: Key Performance Indicators for Compensation Alignment

Effective compensation alignment requires systematic measurement frameworks that capture both quantitative performance outcomes and qualitative ownership culture development. Leading ESOP organizations implement comprehensive assessment approaches that track multiple dimensions of compensation effectiveness.

Employee Understanding and Ownership Value Perception

Organizations must measure employee comprehension of ESOP mechanics and their perceived value within total compensation packages. Key metrics include the percentage of employees who demonstrate accurate understanding of ESOP operations through post-education assessments, and employee Net Promoter Scores specifically related to ownership satisfaction.

These measurements provide critical insights into the effectiveness of ownership education programs and identify gaps in employee understanding that may undermine compensation alignment objectives.

Market Competitiveness and Total Rewards Positioning

Systematic benchmarking analysis should track the percentage of positions maintained within competitive market ranges when ESOP contributions are included in total compensation calculations. This requires annual compensation reviews that incorporate both base salary positioning and projected ESOP value appreciation.

Effective measurement approaches evaluate compensation competitiveness across different employee segments, ensuring that the organization maintains talent acquisition and retention capabilities while leveraging ownership value as a differentiation strategy.

Retention Analytics and Tenure Patterns

Voluntary turnover rates, particularly among high-performing employees and those with significant ESOP vesting, provide direct indicators of compensation alignment effectiveness. Organizations should analyze average tenure patterns in critical roles and correlate retention rates with total compensation satisfaction metrics.

These analytics enable identification of compensation structure weaknesses before they result in talent loss, supporting proactive adjustments to maintain competitive positioning.

Ownership Behavior Engagement Metrics

Measurement of employee participation in ownership-related activities, including ESOP education sessions, annual ownership meetings, and continuous improvement initiatives, provides insight into the cultural impact of compensation alignment strategies.

The frequency of employee-generated cost-saving suggestions and process improvement recommendations correlates directly with the effectiveness of compensation structures in reinforcing ownership mentality development.

Financial Sustainability and Repurchase Management

Organizations must track the accuracy of repurchase obligation forecasting and maintain appropriate cash reserve ratios relative to projected repurchase liabilities. These metrics ensure that compensation strategy decisions do not compromise long-term ESOP sustainability or create future constraints on compensation competitiveness.

Enterprise Performance and Value Creation Alignment

Annual ESOP share value appreciation rates and their correlation with incentive program payouts provide direct measurement of compensation alignment with business performance. Organizations should track profitability growth patterns alongside bonus distributions to ensure that variable compensation reinforces value creation objectives.

The most sophisticated measurement approaches implement five-year trending analysis that correlates compensation investment levels with both employee engagement outcomes and enterprise value appreciation, enabling data-driven optimization of total rewards strategies.

Conclusion: Compensation as Ownership Culture Catalyst

For ESOP organizations, compensation and total rewards alignment represents far more than competitive positioning—it constitutes a fundamental mechanism for reinforcing ownership culture and driving long-term enterprise value creation. The unique challenges inherent in employee ownership structures require specialized expertise, sophisticated financial planning, and ongoing commitment to employee education and engagement.

Organizations that successfully navigate these complexities position themselves to leverage the full competitive advantage potential of employee ownership while maintaining the talent management capabilities necessary for sustained business success. The investment in compensation alignment expertise represents a strategic imperative that directly influences both immediate performance and long-term ownership culture maturity.

The ESOP structure provides the foundation for employee ownership, but effective total rewards alignment creates the engagement and performance differential that distinguishes exceptional employee-owned companies from those that merely maintain ownership without realizing its full potential.